Scotland risks missing out on the global robotics revolution as other nations surge ahead in a market projected to reach £218 billion by 2030, but a major new policy paper published today (19 June 2025) by The National Robotarium shows how the country can still establish itself as a world leader.

Stewart Miller, CEO of the National Robotarium, a Heriot-Watt University Global Research Institute, has today launched the comprehensive policy discussion paper ‘Making Scotland a World Leader in Robotics’ warning that urgent action is needed to prevent Scotland from falling further behind international competitors, while outlining a clear pathway to robotics leadership.

“We’re at a critical juncture,” Miller said. “Countries like China, America, and Singapore are racing ahead in robotics adoption and innovation, while the UK ranks just 24th globally for robots per manufacturing worker. But Scotland has exceptional foundations that, with the right approach, could make us a global robotics powerhouse.”

CEO of the National Robotarium, Stewart Miller (credit Ben Glasgow photography)

The scale of the challenge facing Scotland, highlighted on the front page of The Herald when the policy paper launched, is sobering. Asia dominates with 72% of global robot installations, while Germany installs nearly eight times more robots than the entire UK. Denmark has become a robotics leader through strategic investment in collaborative robots and automation, creating a thriving ecosystem that attracts international companies and talent.

“Other nations aren’t waiting – they’re building robotics capabilities that will define their economic futures,” Miller explained. “While we’ve been developing excellent innovations, our European neighbours and countries like Australia have been creating the systems and support that turn innovation into economic leadership. We risk becoming developers of technology for other countries to commercialise.”

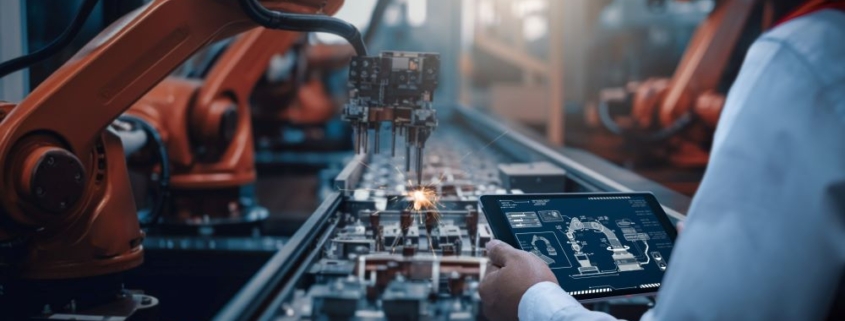

The policy paper highlights the stark reality of missed opportunities. Approximately 20,000 UK manufacturing SMEs currently operate without robotics technology, representing massive untapped potential. According to recent analysis, if UK automation levels matched leading countries, productivity could increase by 22%, potentially contributing £184 billion to the economy over the next decade.

The healthcare sector presents equally concerning gaps. While the global healthcare robotics market is projected to grow to £3.4 billion by 2028, Scotland struggles to translate its clinical expertise and innovation capability into systematic adoption, potentially missing out on £21.7 million in annual efficiency savings for NHS Scotland alone.

“We have companies like Edinburgh-based BioLiberty developing breakthrough stroke rehabilitation technology, but they’re launching in North American markets because we haven’t created the pathways for domestic success,” Miller said. “We’re funding innovations that primarily benefit other countries.”

Companies like Bioliberty have launched stroke rehabilitation technology Lifeglov (pictured) in North America due to lack of pathways to market in the UK

However, Miller’s analysis reveals that Scotland is uniquely positioned to reverse this trend and establish genuine robotics leadership. Unlike countries starting from scratch, Scotland possesses world-class research excellence, outstanding engineering heritage, and proven entrepreneurial spirit.

“The difference between concern and optimism is action,” Miller explained. “Scotland has all the ingredients needed – we just need to combine them more effectively. The National Robotarium has demonstrated what’s possible, supporting over 100 jobs and nurturing 14 innovative companies in less than three years. This success can be replicated and scaled.”

The policy paper identifies three sectors where Scotland can establish clear competitive advantages. The offshore renewables sector offers immediate opportunities, with robotics applications in wind farm operations alone representing a £341 million annual market by 2030. Scotland’s global leadership in offshore energy provides a natural platform for marine robotics excellence.

Healthcare presents extraordinary potential for Scottish innovation. With world-class clinical expertise and growing recognition among healthcare leaders of robotics possibilities, Scotland could become the global centre for healthcare robotics development.

Manufacturing offers perhaps the broadest opportunity, with Scotland’s expertise positioning it to capture significant market share as automation demand accelerates across thousands of ready-to-adopt businesses.

Stewart Miller (pictured with Robotics Engineer Coena Das) argues widespread adoption of robotics in UK manufacturing could lead to greater productivity and efficiencies

“Every challenge becomes an opportunity when viewed through the robotics lens,” Miller said. “NHS pressures could drive healthcare robotics innovation. Manufacturing skills shortages could accelerate automation adoption. Our offshore energy leadership could establish Scotland as the global centre for marine robotics.”

The emergence of embodied AI has created unprecedented opportunities for countries that move decisively. With over a hundred companies worldwide receiving billions in investment to develop genuinely human-capable systems, Scotland’s combination of AI expertise and robotics capability positions it perfectly for this next wave of innovation.

Miller emphasises that Scotland’s advantages extend beyond technology to include cultural and institutional strengths. The country’s collaborative approach between industry, academia, and government – exemplified by the National Robotarium’s ‘triple helix’ model – creates ideal conditions for rapid ecosystem development.

The National Robotarium’s track record provides compelling evidence of Scotland’s potential. Since launching in September 2022, the facility has become internationally recognised, with the Tony Blair Institute for Global Change citing its model in their landmark October 2024 report on robotics leadership. The recent expansion to Orkney through the International Blue Economy Robotarium demonstrates how targeted sector focus can accelerate market leadership.

Professor Gillian Murray, Deputy Principal of Business and Enterprise at Heriot-Watt University, said: “Heriot-Watt has a proud 200-year heritage of pioneering engineering and innovation that has shaped industries worldwide. The National Robotarium exemplifies our commitment to mobilising intellectual and capital assets for global impact. This policy paper demonstrates how Scotland can build on our university sector’s world-class research capabilities to establish genuine leadership in the technologies that will define the future economy.”

Deputy Principal of Business and Enterprise at Heriot-Watt University, Professor Gill Murray

The policy paper outlines a comprehensive vision for establishing Scotland as a global robotics powerhouse through four strategic initiatives:

- Create Robotics Scotland as a national coordinating body to accelerate collaboration between research, industry, and international partners

- Establish a National Healthcare Robotics Initiative to position Scotland as the global leader in medical robotics innovation

- Launch a Marine Robotics Innovation Programme, leveraging Scotland’s offshore expertise to dominate this emerging market

- Develop a National Robotics Skills Strategy, ensuring Scotland has the talent to lead across all robotics applications

Miller envisions these initiatives creating a virtuous cycle where Scottish success attracts international investment, talent, and partnerships, transforming Scotland from a country watching the robotics revolution to one leading it.

“We have all the building blocks in place,” Miller concluded. “Outstanding research through institutions like the National Robotarium, breakthrough innovations in technology, and world-class university capabilities. The question isn’t whether Scotland can become a robotics leader – it’s whether we’ll act quickly enough to make it happen.”

Ben Glasgow photography

Ben Glasgow photography